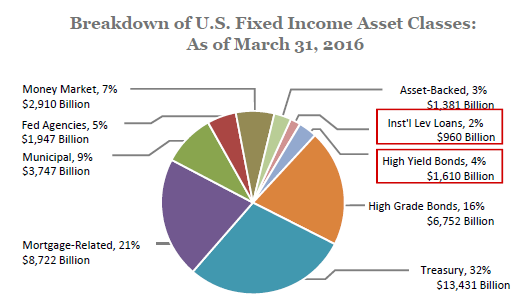

The entire U.S. fixed income market (municipals, Treasuries, mortgages, corporates, federal agency bonds, money market, and asset back securities) totals over $41 trillion.1

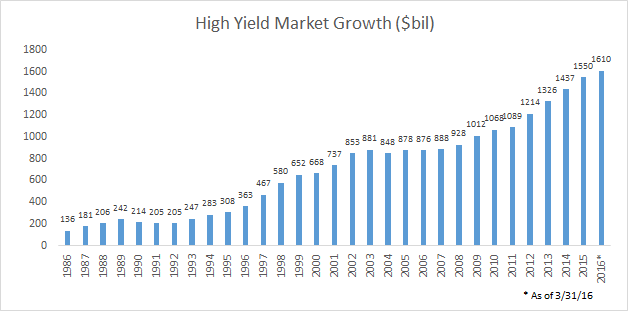

Corporate credit (high grade, high yield bonds, and floating rate loans) is about $9.3 trillion of this pie. The high yield bond market is a growing piece of that corporate debt piece, now at $1.61 trillion.2

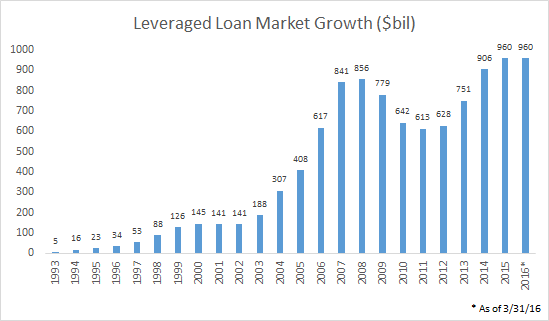

If you add in high yield floating rate loans, that includes another nearly $1 trillion and together high yield bonds and loans account for almost 30% of corporate debt.3

The number above includes only institutional loans, but if you factor in other non-investment grade term loans and bank-held facilities, you get a broader loan market size of $2.3 trillion.4 One thing is clear, that the high yield debt market is a growing market, and one that cannot be ignored for fixed income investors.

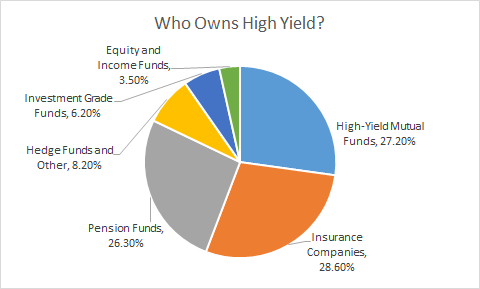

As we look at just who owns high yield bonds, the three largest categories of owners are pension funds, insurance companies, and retail mutual funds, all of which have relatively similar size of ownership at just over a quarter of the market each.5

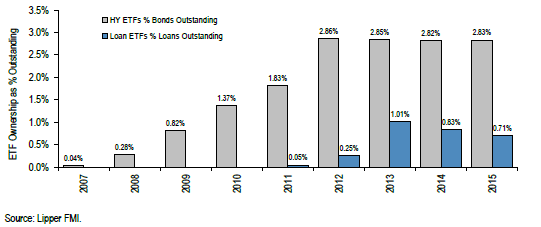

With this we see both institutional and retail customers as active in the space. High yield ETFs account for about 13.5% of the total $271 billion “retail” high yield fund base6, which includes the much larger mutual fund counterpart, and ETFs account for about 2.8% of the broader high yield market and have been around the level for the last four years and loan ETFs less than 1% of that total market.7

While a very small portion of the total market, the place of high yield ETFs within the broader high yield bond market has been a discussion point over the last year, with some critics speculating that some wider-spread selling in high yield ETFs could cause a collapse in high yield markets due to “liquidity” issues. We have previously explained how recent regulations post the financial crisis have led to less market making and lower dealer inventory of bonds, and the impact that has had on markets (see our piece “Understanding Market Liquidity”, “The Pricing Issue in High Yield“).

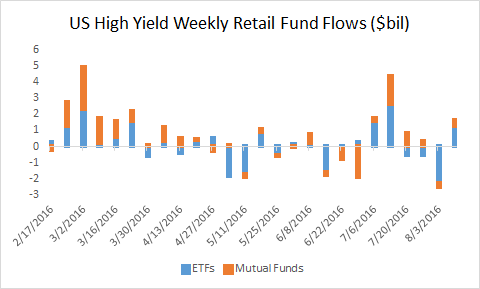

Flows in and out of these “retail” mutual and exchange traded funds (though we know that various institutions are buyers of mutual and ETFs as well) can be volatile week over week, but again, these flows pale in comparison to size of the total market. For instance looking back over 2015, the largest weekly reported weekly retail (exchange traded and mutual fund) flow totaled around $3.8 billion8, and looking at fund flows over the past six months, which include both the largest and second largest weekly fund inflow on record, these flows were still sub $5 billion9, which compared to a $1.6 trillion market means it is about 0.3% of the total market, so seemingly miniscule.

Over this period, the largest ETF-related flow was $2.3bil, so less than 0.015% of the total market. Interestingly, with the increased difficultly in sourcing and buying bonds post the new regulations, we have seen situations recently where institutions turn to buying ETFs and then take the underlying bonds on redemption (in-kind redemption of security versus cash) as a way to quickly and easily gain exposure to the underlying bonds; rather than trying to build a portfolio on their own.

Not only do we see ETFs benefiting from their in-kind redemption mechanisms, in this environment of lower dealer inventory and heightened price volatility, we believe that high yield ETFs provide an advantage over mutual funds during more volatile times because ETFs trade/price intra-day, so we would argue provide a more accurate and true pricing mechanism for going in and out of the high yield market than mutual funds that only trade at the end of the day.

We see the high yield bond and loan market as an important part of the fixed income asset class, especially in this global low yield and high domestic equity valuation environment. We believe that high yield ETFs provide investors great accessibility to the asset class. And while the recent regulations may add an element of volatility to the market, we would view this volatility as an opportunity for active managers like Peritus who have the ability to capitalize on discounts and can be intentional about the credits they invest in. We have seen the high yield market stabilize over recent months but we believe that there are still attractive opportunities within the market.