Markets across asset classes and across the world have been in a seemingly free fall since 2016 began, with equities domestically and internationally, oil/commodities, and high yield bonds, among others, all facing big declines, all while US Treasury bond and US dollar prices have been spiking. The “risk-off” trade is in full swing as we sit in this third week of the new year.

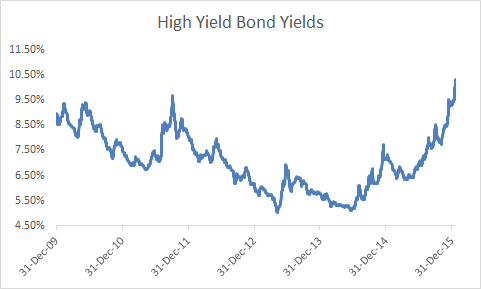

As we recently wrote, we do believe there is further downside to be had in equities as the re-pricing to account for current global and economic conditions is just beginning there (see our piece, “The Equity Alternative”). However, the high yield bond market has been in the midst of repricing for well over a year now. Over this period, high yield bond yields have more than doubled off of the June 2014 level of 5.19%.1 Just in the first few weeks of this new year, we have seen yields in the high yield bond market widen by 103bps, putting us well above 10% for the first time since October 2009.1

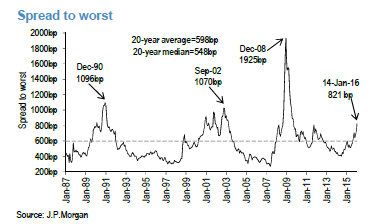

Year-to-date, spreads have widened 125bps and now sit at 882bps.3 This compares to the 20-year average spread level of 598bps and 20-year median spread level of 548bps.4

J.P. Morgan recently noted the following:5

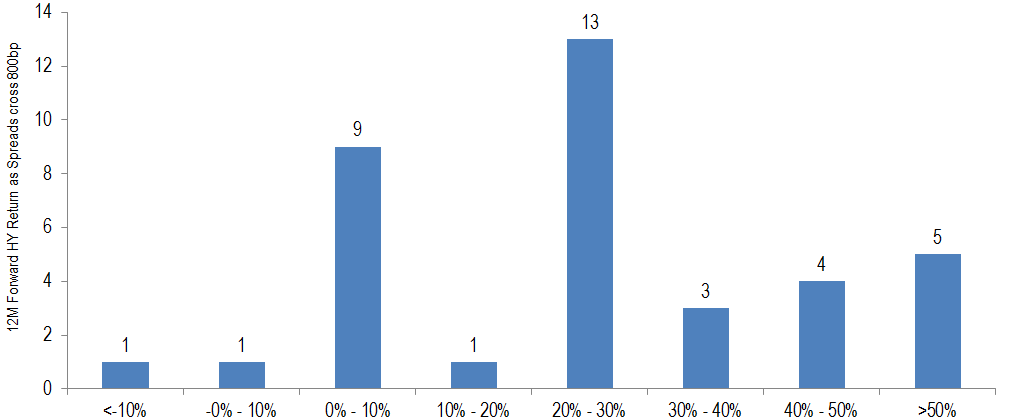

Over the past 25yrs spreads have only been above 800bps slightly over 10% of the time (37 months) and notably, total returns were remarkably strong over the next twelve months in all but a few instances. The only two negative outcomes was if an investor bought high-yield bonds as spreads crossed 800bps in March 2008 (-20.1% next 12 months) or February 2001 (-0.2% next 12 months). The median and average total return over the next 12 months for high-yield bonds as spreads crossed 800bps was 24-25%.

Source: J.P. Morgan

So really, the only significant one-year forward negative return was had for those that purchased high yield during the period that Bear Stearns was blowing up, which proceeded the prolonged downturn of the financial crisis by about six months. History would indicate that once the pain is taken and spreads hit these elevated levels, high yield bonds are quick to recover.

Historically we generally see these sorts of spread levels in high yield bonds as we are approaching/in the midst of a recession, where fundamentals are deteriorating (big profit declines, leverage increasing, etc.). We largely aren’t seeing that today, outside of energy and other commodities. Don’t get us wrong, the energy and commodity space are in a depression and there will be many defaults in this space, especially as we see oil around $30. These segments account for just under 20% of the high yield market. However, in the other 80% of the market we aren’t seeing fundamentals taking a big hit. For instance in the last full earnings reporting season (Q3 2015), we saw revenues increase 1.7% and EBITDA (earnings before interest, taxes, depreciation, and amortization) increase 14.2% excluding energy, metals, and mining.6 Given the lack of leverage in the system, we certainly don’t believe we are on the precipice of any sort of financial crisis. Rather markets around the world are adjusting to lower growth and the end of a commodity cycle. While we will certainly see slowing here at home, we don’t see a recession as likely.

We see the current situation as similar to the last time spreads surpassed 800bps, which was in late 2011 during the midst of the European crisis, when the world wasn’t sure if the European Union would survive. Markets at that time were also in “risk-off” mode as they are today, but a recession domestically was not occurring or imminent. During that period, spreads peaked at 861bps in October 2011. The 12 month return following the period when spreads first surpassed 800bps at the end of September 2011 was +19.5%.7

Fear and selling pressure in a market that is less liquid due to the post-financial crisis regulations put in place is creating a pricing problem in high yield—as funds go to market to meet redemptions, this is forcing prices down, in some cases significantly. We’d always expect to see prices go down when people are selling, but in today’s high yield market that is being acerbated by the fact that banks are not making markets like they used to and there is much less dealer inventory as a result of these regulations. We see it as more of a technical issue rather than a fundamental, systemic issue; a pricing problem rather than a credit problem. With the still solid fundamentals on much of the high yield market (ex-commodities) we see this as a buying opportunity to take advantage of the non-fundamentally driven pricing gaps; we believe it is certainly not the time to sell. While trying to time a market perfectly is often futile, with now double digit yields offered in the high yield market and spreads over 800bps, we believe this market offers selective value for active investors, positioning investors well for future returns and providing them with income/yield while they wait for the volatility to subside.