Three weeks ago, we posted a market commentary arguing that the run for equities was over, as we saw little in the way of catalysts ahead (High Yield vs. Equities—Is This the End of the Run for Equities?). In the three weeks since, we have seen the S&P 500 fall 8.7%, the Dow is down 8.8%, and the Nasdaq is down 11.4%.1 It’s been a rough start to the new year to say the least!

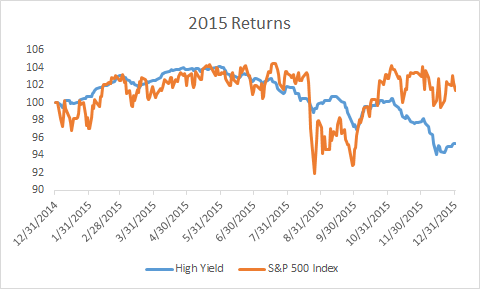

The credit markets have been telling us for months that things weren’t as rosy as the equity markets seemed to believe, as evidenced by the divergence in returns over the latter half of 2015.2

Now, equities are waking up to this reality and we expect it will take some time for them to adjust. The economy is struggling, growth and demand is stagnant worldwide, currency/foreign exchange is taking a toll on sales and profits, and energy and other commodity prices are in free fall. As we enter the earnings season, estimates are for a 5.3% decline in Q4 earnings for the S&P 500.3

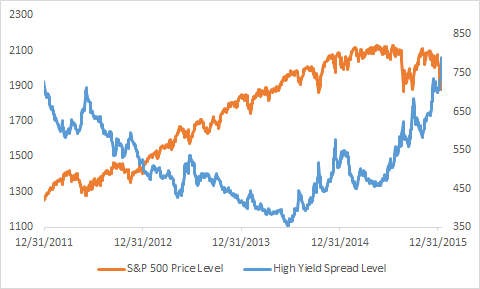

With high yield, we aren’t reliant on growth or earnings; rather, we primarily need the company to continue to pay their bills, including our interest payment, and be able to be refinanced at the call or maturity date to realize our yield. As we face what many have termed an “earnings recession” we favor credit over equities, especially considering from a valuation perspective, high yield has already taken its pain, adjusting to spread levels that we last saw four years ago.4

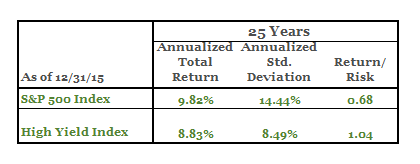

Additionally, is it often an overlooked fact that on a risk adjusted basis (with risk measured by the standard deviation of returns) high yield bonds have historically outperformed equities. Here is a look at the last 25 years, where on a return/risk basis high yield has significantly outperformed equities.5

We view high yield as an equity alternative given the relatively similar historical returns profile, and in the year ahead, we would favor high yield bonds over equities. Credit markets led the way down and we’d expect them to lead the way up. While it’s impossible to perfectly time the markets, sitting on the sidelines means sacrificing the attractive yield we see as currently provided by high yield bonds. The high yield market is offering big price discounts to par and a yield closing in on 9.5% on the index6, and we see the potential to capture even more yield in an actively managed portfolio. As we sit today, we are back to spread and yield levels not seen since 2011 in high yield bonds, while the S&P 500 is back to its August 2015 levels. The high yield market has taken its pain and we believe now provides an attractive entry point for investors.