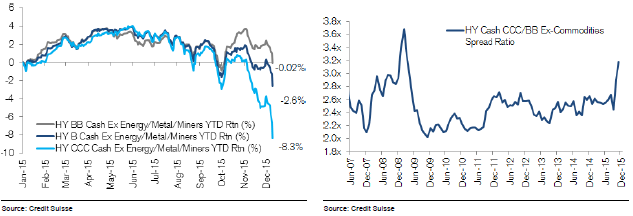

As we look at today’s high yield market, we are seeing a bifurcated market, and opportunity, in terms of the various ratings categories. During 2015, CCC credits were down 12%, or down 8.3% excluding commodities, while BBs were down just 0.2% ex-commodities. This has put the spread offered between CCC-rated companies relative to BB-rated companies ex-commodities back to levels not seen since the financial crisis, as pictured below.1

HY returns by rating ex-commodities HY CCC/BB ex-commodities spread

We have been vocal on our take on the rating agencies. We view the ratings process as flawed as it is often reactive not proactive, focusing on the past versus the future. Also, the dividing line between each ratings category, such as BB versus B or B versus CCC is so arbitrary and subjective. The ratings agencies themselves call their ratings opinions and say that investors should not solely rely upon them in them in making investment decisions. So often in our careers we have seen a company that we believe to be fundamentally solid, remain CCC-rated forever, all the while paying their bills, refinancing their bonds prior to maturity and issuing new debt, while we were able to pocket what we viewed as an outsized yield due to the rating. On the flip side, we’ve seen on many occasions bonds go from B swiftly to D or even a quick trip from investment grade to default. Investors need only look to the likes of Lehman, WorldCom, and Enron, as well as the AAA rated debt in the sub-prime crisis to have evidence of just how inaccurate the ratings agencies can be. Even over the last day, we saw a rating agency take a bond down five notches from B+ to CCC- on concerns about a restructuring. Clearly the company’s financial condition did not deteriorate overnight—this was an oil and gas exploration and production company, and we all know oil prices have been in free fall for over a year now. All that to say, the ratings agencies can be very slow on the upgrade and the downgrade, as well as wrong in their assessment of true risk.

The reality is that investors often make allocations based on ratings; thus creating inefficiencies that lend themselves to active management within the high yield market. We believe investors who invest by these ratings alone are putting themselves at a disadvantage. Active managers that are able to dig into the fundamentals of the business and determine their own opinion on the financial condition and outlook for the company can assess if the credit is money good, thus in essence an “AAA” credit, or if the capital structure is at risk, thus a “D” credit. Just because a company is B or CCC doesn’t mean that it is on the path to a default; instead, that outsized yield may be an opportunity.

We see plenty of B and CCC rated companies with stable business profiles and generating free cash flow. The one size fits all rating approach doesn’t work well within investing. For instance, ratings agencies look at leverage, but often don’t factor in that certain industries always seem to run at high leverage levels but it is supported by the M&A transaction multiples we see in the industry. For instance, many credits in the food industry often seem to run at higher leverage profiles than many other high yield issuers and thus always seem to have lower ratings, but often these brands have strong value and M&A activity is at very high transaction multiples, more than covering the leverage. This along with the cash generating ability and generally recession resistant/stable business profiles have made these names attractive investments for us over the years despite the ratings. We’ve also seen cases where the ratings agencies assign a ratings based on the total leverage of a company, and not factoring in a huge cash balance for a much lower net leverage profile. Or when companies take advantage of big declines in their bonds prices and buy back bonds in the open market, the ratings agencies at times have considered these “selective defaults” despite the fact that the company has not defaulted on any obligation, the company is buying these bonds from are willing sellers, and the company is reducing their leverage profile and lowering their interest costs thus improving their long term cash flow generating ability by making these discount purchases. In short, we see the ratings methodology as flawed.

We have always believed the ratings process creates inefficiencies and opportunities within the high yield market and with the outsized decline in lower rated bond categories within high yield over the last year, we are seeing even more selective opportunities to take advantage of today. Certainly some of the lower rated paper is justifiably lower rated and in some cases, the yield generated isn’t worth the risk. But investors need to determine this for themselves. Investors need to analyze the company’s business fundamentals and financial profile and consider the company’s future prospects to assess if it is a money good credit or not, and make the investment allocations accordingly. We believe that today’s bifurcated market is creating opportunities that active, fundamentally-driven investors need to take advantage of.