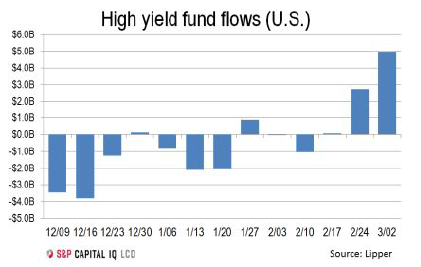

After a rough last couple months—or in actuality a rough past six months—we are starting to see some positive signs in the high yield market. After yields surpassed 10% in mid-February1, we are beginning to see investors come back into the asset class as energy prices somewhat stabilize and investors look to take advantage of the yield offered by this market. Notably, we’ve seen the outflows from exchange traded and mutual funds reverse over the last few weeks, with the inflow in the most recent week posting an all-time high at just under $5.0bil.2

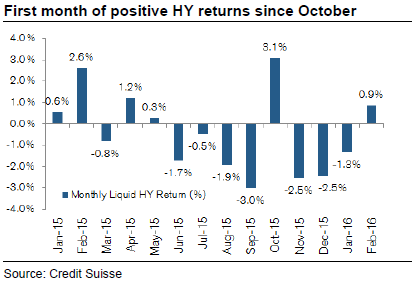

As we see investors start to embrace the asset class again, February posted the first month of positive returns since last October.3

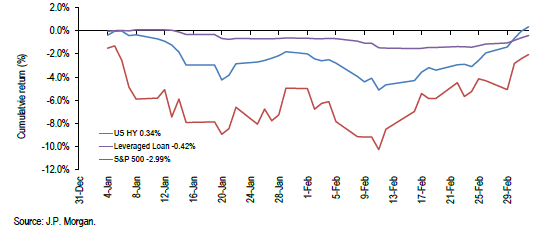

If we include performance through the first few days of March, we actually see that high yield bonds have now fully recovered their 2016 loses.4

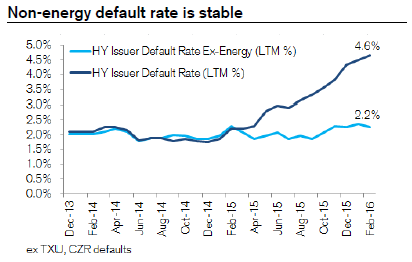

While energy and metals and mining defaults continue to accelerate, the default rate on the rest of the high yield market remains stable.5

The energy and commodity default rates have shot up and we expect them to continue to do so. We have seen a number of energy companies, including some very large ones, undertake bankruptcies over the past couple months because even though energy prices have somewhat stabilized, this $30ish level is not a level at which many of these players can survive.

We believe the strong negative sentiment toward the high yield market that we have seen over the past several month is starting to subside as investors once again begin to embrace the asset class. However, we believe active management and the flexibility to not invest in certain credits seen as vulnerable is essential as investors re-enter the space as defaults in the energy and commodity sectors are just starting to heat up and these sectors together remain around 15% of the index.6 Even though we have seen some upturn in the high yield market, we still believe it offers investors attractive value for both capital gains potential and yield and still has plenty of room to run given how low pricing and how high spreads had gotten.