While the market seems to be jumping to the conclusion that infrastructure and other government spending and the benefit of lower taxes will drive growth and inflation, taking interest rates higher, we aren’t a believer that we will see dramatic move upward in rates from where we are now. But while we are not a believer in a run in rates, let’s take that side of the trade for a minute. For the sake of argument, let’s say the Fed raises the Fed Funds Rate 25bps this month and then does another 3, 25bps rate increases in 2017. So now the Fed Funds Rate is up 1% and let’s assume over this year, Treasuries have increased 1% as well from the pre-election levels. What would that mean for us in the high yield market? First, we need to keep in mind that Treasury rates are forward looking so will price in expectations long before the Fed takes any action. Additionally, we would expect the short end of the curve to get hit more, less so for the medium and longer end of the curve that matter more to us in the high yield market. Given the massive back up in rates over the last two weeks, the market has likely priced in much of this potential move. In Street parlance, buy the rumor, sell the news.

History gives us a picture of how high yield has reacted during times of increasing rates. During the more recent “Taper Tantrum” in 2013, we saw the 10-year move up 136bps from April 30th to December 31st 2013, and the 5-year move 107bps over that same timeframe. During the first couple months of that Treasury move, we saw the 10-year increase about 80bps and while that increase was happening, the high yield market fell 3.1%. But over the course of the rest of year (July-December), during which the 10-year moved up another 54bps, we saw the high yield market return 5.8%.1 Keep in mind, going into this move in rates in 2013, the yield-to-worst on the high yield index was 160bps lower in April 2013 than it is now, and was hitting all-time lows in yields right as the “Taper Tantrum” was beginning. 2 Not only that currently yields are right about where they were at the peak of the “Taper Tantrum.” 3 So the high yield market looks to have been more sensitive to changes in rates then versus where we are today given the yield levels at the time.

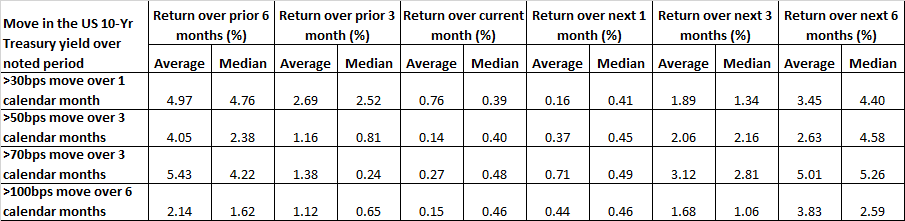

If we expand this view to look at the long-term 30-year history of the high yield market, we continue to see that the high yield market has performed well in the face of rate increases.4

On average, returns have remained positive in the midst of the increases, and have performed very well over the next 3-6 months. So while we remain skeptics of a rising interest rate environment, we believe investors are well served by the high yield market whether rates rise or not.

For more as to the impact of rates and how the market has historically performed during periods of increases, see our writings “Strategies for Investing in a Rising Rate Environment” and “High Yield in a Rising Rate Environment”. As noted in these pieces, historically the high yield market is negatively correlated to Treasuries, meaning as Treasury prices decline and rates/yields increase, high yield prices increase. This market has historically performed well during years when we have seen rising rates, helped by the improving economy that has traditionally corresponded with increased rates, as well as the higher starting yields and a shorter maturities we generally see in the high yield market versus other fixed income sectors, both of which help reduce duration.

Duration is a measure of interest rate sensitivity, and that, along with yield, are important metrics to consider in the face of potentially higher rates. Keep in mind the high yield market is not homogenous. As we have seen a swift rebound in high yield bond prices so far this year, we have seen spreads compressed to very low yield levels on a number of high yield issues. In looking at the Bank of America High Yield Index, nearly 40% of the individual tranches trade at a yield to worst of 5% or less5, while there is also a large portion of the market that offers yields that we would view as attractive. So if we were to see a 1% increase in rates, that would have a much more significant impact on securities yielding 3% or 4% within the high yield market, along with investment grade and municipals that are yielding even less, versus the securities yielding 7, 8, 9% or even more, also available within the high yield space. Yield is one of the main components of duration, so all else equal, the higher the yield, the lower the duration and vice versa, the lower the yield the higher the duration. This is just one way where an actively managed approach can add value.

While we are not believers in the rising rate story, for those who do believe that rates are bound to rise from here, we see our high yield bond and loan asset classes as one of the few places inside the fixed income universe that investors can make money. For more on our thoughts on the economy, rates, regulations, and the outlook for the high yield market as a result of the recent election, see our piece “The Election Impact on High Yield: Rates and Regulation.”

For information on the AdvisorShares Peritus High Yield ETF (ticker HYLD), the actively managed high yield exchange traded fund that the Peritus team is sub-advisor to, please visit, www.advisorshares.com/fund/hyld, distributed by Foreside Fund Services, LLC.