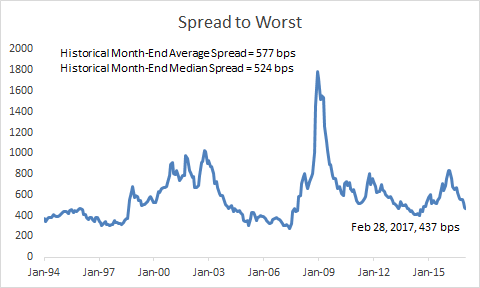

Every investment opportunity set (asset classes and individual securities) has risk. The key is to identify the risk and “price” it correctly. For us, assessing and pricing risk involves analyzing credit spreads in light of their expected default rates. This can be done for the high yield bond and loan asset classes as a whole and for individual securities. For the indexes today, those spreads have narrowed significantly and currently sit at 437bps, relative to historical medians of 524bps and historical averages of 577bps.1

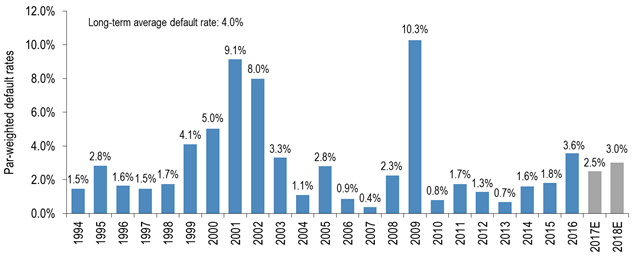

As we look forward, spreads are pricing in a very low default rate, which is expected to be 2.5% this year, versus historical averages of 4%.2

While we do not disagree that default rates will be subdued for the next couple of years, there is no arguing that spreads for the indexes seem to be pricing in near perfection. Given that spreads are below median/average levels as we begin 2017, we do not want to be tightly correlated to the indexes. Rather, we will be opportunistic in our approach to buying securities and expect that 2017 will reward bond pickers not asset allocators.

Thus, we believe active management will be key as we move through the year. As always, credit is a negative art. This means what you don’t own is just as important as what you do own. As we begin 2017, we see that securities of many cyclical industries have rebounded to a level where investors are not being compensated for the volatility of revenues and we will steer clear in our portfolio. But in terms of what we do own, as active managers, we continue to look for credits where the three “U’s” are firmly in place: undervalued, unloved and most importantly—UNDER-OWNED. It is hard to argue that any asset classes today fits that bill but we can certainly make a very good argument that individual securities can.

As active credit investors, we are contrarians by nature. We are not contrarians for the sake of being different, but rather for trying to generate real alpha. Within our core holdings, we want to purchase securities that have low expectations, not securities that are priced to perfection. Thought of another way, there are very few bad bonds but lots of bad prices and it is our job to figure out if securities are priced where they are for the right or wrong reasons. Sometimes this mis-pricing (under-valued situation) is created through company specific news and sometimes it is industry contagion.

One industry where we believe opportunities may evolve is in healthcare with the “repeal” of Obamacare. Nobody really knows what “repeal and replace” actually means but the volatility created by President Trump’s rhetoric is likely to produce some interesting opportunities as the year develops. It is highly unlikely that currently insured patients will be simply dropped from coverage. Specialty pharma is another area that we continue to like, as the inevitable bashing on drug pricing works its way through Congress. This is one of the few industries that we have seen substantial organic revenue growth, and while more competitive bidding is likely to pressure some companies, many others not impacted will likely be thrown out in the inevitable contagion trade.

In terms of the “under-owned” credits, that involves looking in areas other aren’t and not setting arbitrary restraints that force us to invest in the same, often largest issues everyone else is. For instance, the largest high yield index-based ETFs invest according to underlying indexes that have size restrictions of $500mm or $400mm in individual tranche size/$1billion in total debt outstanding.3 So this can serve to eliminate approximately half of individual bond issues4, and historically it has often been in these eliminated medium-sized, niche companies where we have found the most value.

There are always attractive opportunities within the high yield market but 2017 is a time to focus on value and price in risk as you strategically compile a portfolio. One thing we are highly confident of in 2017 is that volatility will increase significantly. European elections (along with Brexit) are sure to add some fuel to the protectionist fire. This could have the effect of increasing risk premiums and credit spreads. Since we have a sanguine view on default risk, we think the biggest challenge for 2017 will be volatility and manic risk premiums, as we can envision a credit market that suffers bouts of neurosis as President Trump’s threats ebb and flow.

With our active strategy we will take advantage of the opportunities that present themselves in this environment while working to stay more defensive and avoiding the credits that we see as over-valued and “priced to perfection.” To read more on our take on interest rates, the global outlook, and our investment strategy in this environment, see our recent writing “Pricing Risk and Playing Defense.”