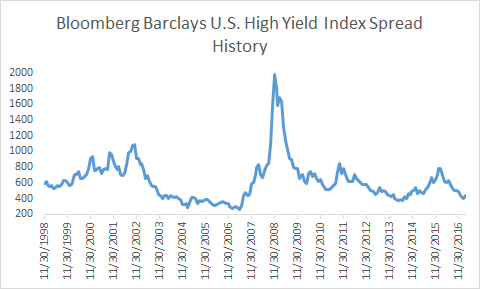

We have seen a huge rally in high yield over the last year. As the high yield market was positioned a year ago, oil was just bouncing of its lows in the $20s, contagion from the energy sector (given energy was by far the largest industry group in the high yield market) had translated into weakness in pricing across the broader high yield market, and a surge in defaults was expected to happen. As we sit today, spreads have compressed significantly, which gets to the question, is there still some valued to be squeezed from this market? And further, given the recent volatility we have seen in energy prices this month, what will keep us from getting back to the early 2016 scenario?

First and foremost, yes we have seen some recent volatility, but we don’t expect oil prices to fall back into the $30s, much less the $20s. There were very significant production increases going into the announced cuts by OPEC and others. This coupled with the calendar (this is a very slow demand time of the year) have led to continued stubborn inventory issues. However, these inventory issues primarily relate to the US, not global inventories, as inventories in other OECD countries are coming down and will continue to come down. OPEC is sticking to their output cuts and is expected to extend their cut agreement. Seasonal demand is going to be picking up in Q2 as refiners crank up for the heavy gasoline season (summer driving season), which will cause inventory draws. Domestically, outside of the Permian, none of the other zones (Bakken/Eagle Ford) are making money in the $40s and this will continue to be the case as producers experience cost inflation from servicers. So if we get to a point that US producers aren’t making money, they will cut back on their production. Furthermore, some of the recent downward pressure has been technically driven from the unwinding of net speculative long positions, which are believed to have peaked in February. In short, global supply/demand balances will remain in a deficit through 2017, which will provide longer term support for prices despite the short-term volatility.

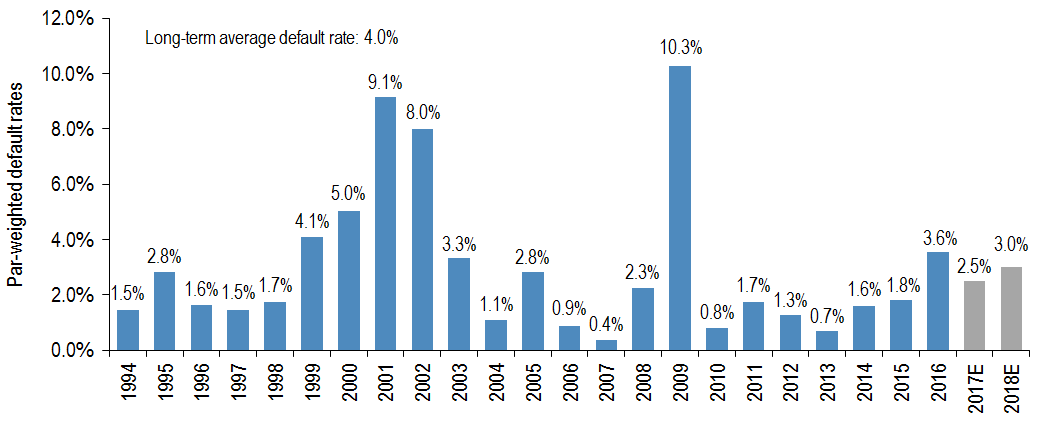

It should also be noted that we did see a spike in defaults last year, as the weakest of energy companies were weeded out and/or have now restructured, putting them in better position going forward. However, defaults are already trending down significantly and as we look into the years ahead, defaults are expected to remain below average.1

This gets to the second question, given the spread compression over the last year, is there still value to be had in the high yield market? While spreads are below historical averages, they are well above historical lows2 and the below average spreads make sense given the below average default outlook.

But given the spread compression, we do have to be cognizant of the environment we are in, as we have seen spreads in a number of securities compress to levels where the security’s yield is not compensating investors for the security’s risk in our opinion. Risk premiums are our major concern and as we look at individual securities, we ask ourselves, what is an attractive and appropriate yield for this degree of risk? Despite many overvalued names, we are still finding undervalued securities where we see attractive yield relative to risk. We have also worked to position ourselves to be more defensive, increasing our new issue allocation, moving to more senior bonds in some cases, and not stretching for yield.

As an active manager, we work to manage yield per unit of risk as we focus on credits that we see as offering value. We expect to have a tracking error versus the index, which we see as a positive because it means we are differentiating ourselves. Investors need yield, and in this low yield environment, we believe that an active/selective portfolio of high yield bonds can provide an attractive yield for investors.