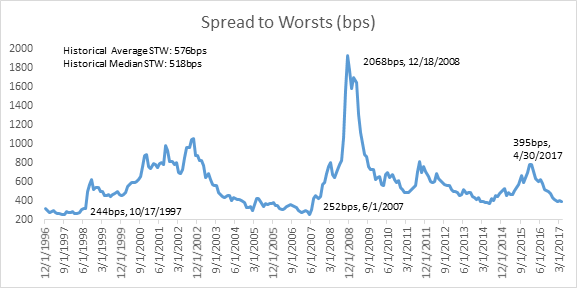

We are hearing concerns from some about valuations within the high yield market. Spread levels are one way we assess value within this market and current spread levels are below historical medians and averages.1

We believe this makes sense given the stable fundamentals and below average default outlook for the next couple years. But as we assess these spread levels and valuations, there are a few important factors to keep in mind that we have learned over our decades of investing high yield bonds. Just because spreads are low, it doesn’t mean that they can’t compress further. Looking over the past twenty years, the all-time low in spreads is 244 bps in October 1997, and then a close second of 252bps in June 2007, well tight of where we currently are. Tighter spreads can continue for months and years.

Additionally, the income this market generates matters in terms of total return. In fact, over the past nearly 25 years, the price return has been slightly negative for the high yield market, but the total return has been 7.8%, indicating the return came from the coupon income this market generated.2 Again, markets can stay “tight” for years, and if you are sitting on the sidelines, you are losing valuable income during that time.

However, we also feel it isn’t wise to sit blindly by, just buying an index-based fund and hoping for the best. As we look at the high yield market, we do see a lot of expensive merchandise, with many securities trading at sub-5% and even 4% yields. In fact looking at the index, nearly 25% of the individual issues trade a yield-to-worst of 4% or less and about 50% of individual issues trade at a YTW of 5% or less.3 For those that believe rates are going higher, these very low yielding credits, many of which have longer maturities due to the big refinancing wave we have seen over the past several years, will be more interest rate sensitive. And then there are credits with really juicy yields, but in many cases you are really stretching for that yield in terms of the credit risk you are taking on. We certainly believe this is not the type of market in which you stretch for yield, as if things turn, we would expect those sort of names to experience more volatility.

But there is a middle ground, and this is where Peritus operates. There are still reasonable yields to be had within the high yield market where you don’t have to take on what we would see as aggressive risk, but also don’t have to just accept yields as low as 3% or 4%. We also complement our core, alpha focused bond and loan holdings with an allocation to newly issued bonds, as we have discussed before. We believe these securities have a benefit in terms of better liquidity than more seasoned credits and we would expect lower volatility in the event of a downturn due to the liquidity benefit and the fact that in order to issue bonds, companies typically have to go through a vetting process and present their business and financials to potential investors. While not a true “hedge” in the sense we are taking any offsetting positions to lower risk, we do see this strategic allocation as a way to lower volatility within the strategy. Furthermore, if we see the market back up and spreads widen, creating what we see as attractive entry points into a number of credits, we have the ability to sell our new issue names and redeploy proceeds into more alpha focused credits.

An investor can try to time the market, but we’d see it as nearly impossible to do with consistent success because markets aren’t rationale. And there are so many points over the years that investors may have thought things were getting tight and got out, but then missed months and years of what we see as the high, tangible income the asset class has historically generated. We are still seeing selective individual securities that we believe are undervalued or fairly valued and we believe the current environment favors active managers like Peritus who can focus on finding that value and positioning their portfolio for the current market.